With the exception of transactions that involve ‘onerous transfer of real property classified as ordinary asset’, the monthly payment of expanded withholding taxes follows a similar schedule as the filing of withholding taxes on compensation.

Those required to file this type of tax must file BIR Form 1601-E (Monthly Remittance Return of Income Taxes Withheld (Expanded)) and BIR Form 1604-E (Annual Information Return of Creditable Income Taxes Withheld (Expanded)). This type of withholding tax applies to certain income payments, including professional/talent fees, rentals, payments to contractors, and commission for services rendered, just to name a few. If paying via eBIRForms, it must be made on or before the 10th day of the following month, except taxes withheld in December, which has a deadline of the 15th of January the following year.

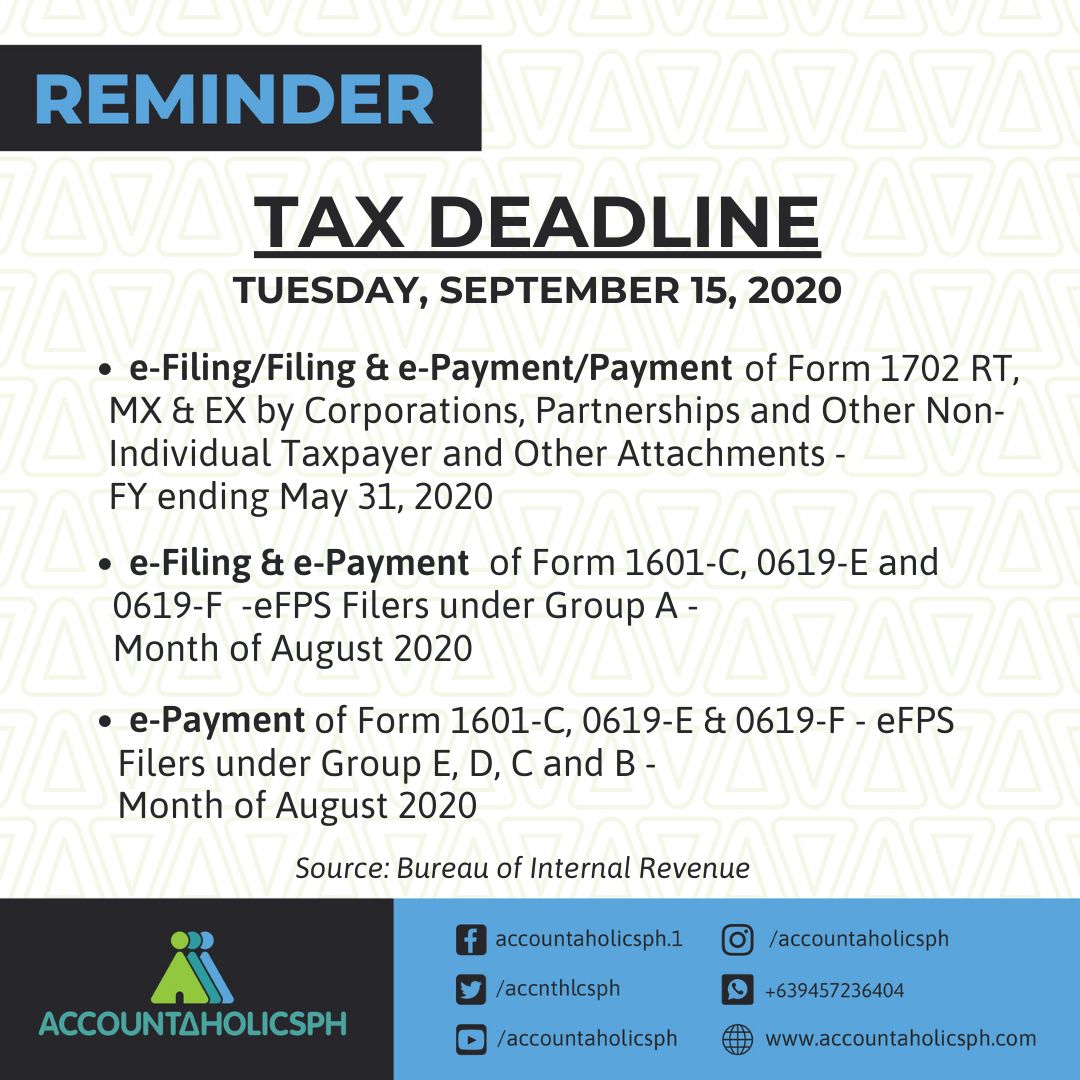

Payments, meanwhile, may be made until the 15th of the month following the month the withholding was made except for those withheld in December, which must be paid on or before the 20th of January the following year. Withholding tax on compensation is filed monthly using BIR Form 1601-C, and constitutes a part of BIR Form 1604-CF (Alphalist of Employees/Payees), which is filed annually.ĭepending on the industry classification you fall under, you may file for this type of withholding tax via the Electronic Filing and Payment System (EFPS), every month and any time from 11 to 15 following the end of the month. This is probably the most familiar type of withholding tax, which is withheld from the income of an individual in an employer-employee relationship.

This is further subdivided into several types, specifically: As the name would suggest, a withholding tax in general is a tax withheld on income derived by taxpayers either through trade or in the practice of their profession.

0 kommentar(er)

0 kommentar(er)